How the Right MIx of Research Fuels Insights Validation

We’ve all been there. We THINK we know what our customers want and how to deliver to them. But, more often than not, we realize that what we think we know is different than what we actually know or what we knew in the past is only what we think we know now.

It’s that seed of doubt that drives those of us involved in market research to validate the insights we think we know and underlines the value of the answers we can provide to clients in marketing and communications. In market research as well as in marketing, it’s good to understand where the drivers of uncertainty are and how the methodologies you enlist impact them.

At a basic level, alpha and beta risks live among us. Simply speaking, alpha risk is the likelihood that we decide to move forward with a decision when, in fact, the data should show that we should not (i.e. a false positive). Related, beta risk is the probability that we choose not to move forward with a decision when we should have (i.e., a false negative). Either way, we lose opportunities by investing our resources in the wrong initiatives.

So, what can we do? Besides being aware of alpha and beta risks, we should be sure we’re familiar with the range of market research methodologies available and look to find the right mix of methods that best fit our needs. It’s important to remember that it’s the questions we’re looking to answer that should determine the research methods and not the other way around.

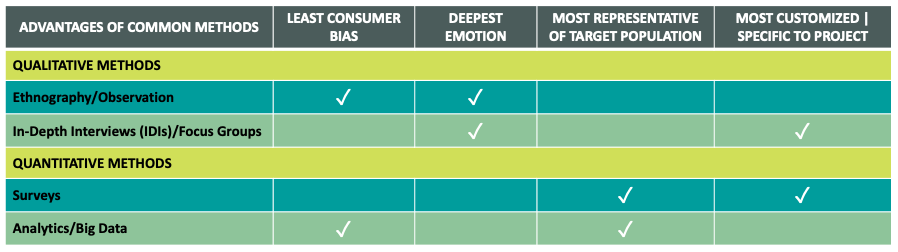

In general, market researchers have four basic methodology approaches to pull from for any research design: in-context ethnography/observational techniques, moderated in-depth interviews and focus groups, various forms of surveys, and the analysis of a myriad of data sources available.

As you can see, each approach has its pros and cons related to factors that are important to marketing initiatives. For example, ethnography and analytics have the least consumer bias because they don’t rely on consumer recall, but their organic nature limits the ability to ask specific questions that are possible in surveys and in-depth interviews. Surveys and analytics tend to capture a larger proportion of a target audience for more statistical confidence, yet lack the ability to fully understand the consumers’ emotions and explanations.

COMPARING COMMON RESEARCH METHODOLOGIES

Due to these differences, often a hybrid approach, mixing two or more methods, is the best way to increase your confidence that you’re closer to actually knowing than just thinking you know.

Here at Lillian Labs, our core expertise is doing qualitative work, but we’ve successfully mixed in other research methodologies to get critical questions answered. It sometimes impels us to broaden our research capabilities, but the payoff for knowing that we know is well worth it.